Conventional Jumbo Loan Limits 2025. While jumbo loan limits vary by lender as far as the maximum they will lend, the question most borrowers want to know is when does a loan become a jumbo loan. What are typical jumbo loan.

Conforming loans are backed by fannie mae and freddie mac and can’t exceed fhfa loan limits ($766,550 in most areas). What are typical jumbo loan.

2025 Conventional Loan Limits Price Mortgage, This means that you can borrow up to $766,550 in most areas without having to go through a “jumbo” loan process, which typically involves stricter underwriting requirements, higher interest rates, and other challenges. A jumbo loan is any home loan that is greater than the conventional.

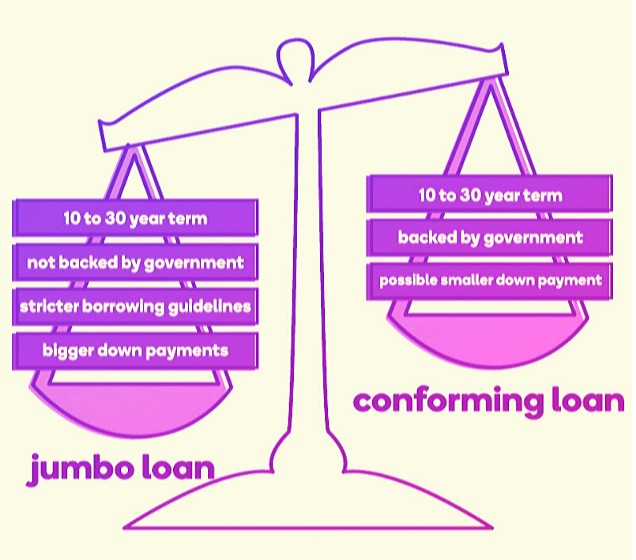

Jumbo Loans vs. Conventional Loans What's the Difference?, Nonconforming loans can be bigger. Any mortgage amount above this new conventional loan limit will be classified as jumbo.

:max_bytes(150000):strip_icc()/dotdash-jumbo-vs-conventional-mortgages-how-they-differ-v2-75c8bd243a054517aa21385ef266c11d.jpg)

San Diego Loan Limits VA, FHA, Conventional & Jumbo (2025), For 2025, the conforming loan limit is $766,550 in most places. Here’s why apr is important.

Jumbo Loans to Help You Live Larger than Life Loanry, That makes them inherently riskier than a conforming loan. A jumbo mortgage is a home loan that exceeds the borrowing limits of a conventional conforming loan.

Jumbo Loan vs. Conventional Mortgage What’s the Difference?, That’s about a 6 percent increase from the 2025 limit. What is a jumbo loan?

Will Conventional Loan Limits Increase in 2025? Here's What to Expect, For 2025, the conforming loan limit is $766,550 in most places. While jumbo loan limits vary by lender as far as the maximum they will lend, the question most borrowers want to know is when does a loan become a jumbo loan.

New FHFA Conforming Loan Limits for 2025 (conventional), While jumbo loan limits vary by lender as far as the maximum they will lend, the question most borrowers want to know is when does a loan become a jumbo loan. Conventional loan limits are the maximum amount a person can get when applying for a private mortgage.

Guide] Arizona Conventional and Jumbo Loan Limits FAQs, While jumbo loan limits vary by lender as far as the maximum they will lend, the question most borrowers want to know is when does a loan become a jumbo loan. What is a jumbo loan?

![Guide] Arizona Conventional and Jumbo Loan Limits FAQs](https://www.agavehomeloans.com/wp-content/uploads/2021/11/shutterstock_1846741273-1024x683.jpg)

New 2025 Conventional loan limits are now 647,200 Now available, For much of the u.s., the divide between conforming loans and jumbo mortgages is $766,550 in 2025. Learn more about how much you can borrow.

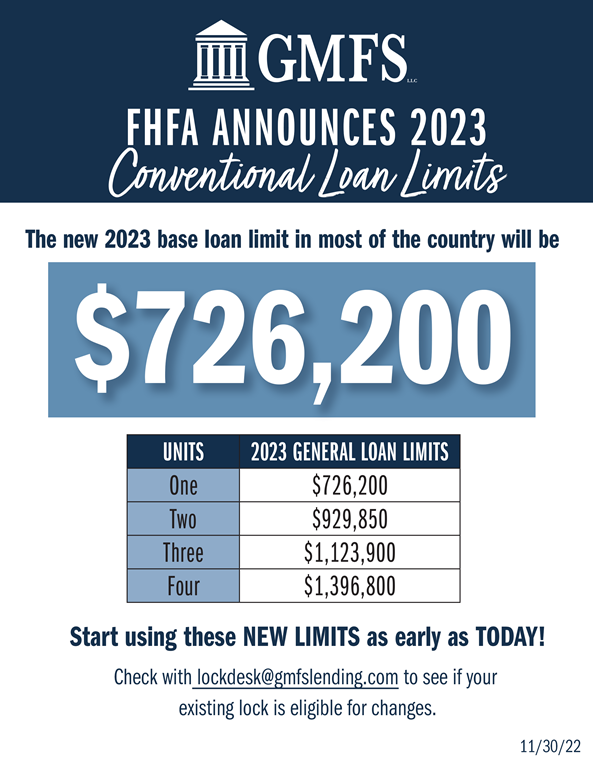

30+ gmfs mortgage servicing loans RoseannAdrian, This means that you can borrow up to $766,550 in most areas without having to go through a “jumbo” loan process, which typically involves stricter underwriting requirements, higher interest rates, and other challenges. Learn more about how much you can borrow.